Top 5 Best Performing ETFs of 2018

Top 5 Best Performing ETFs of 2018

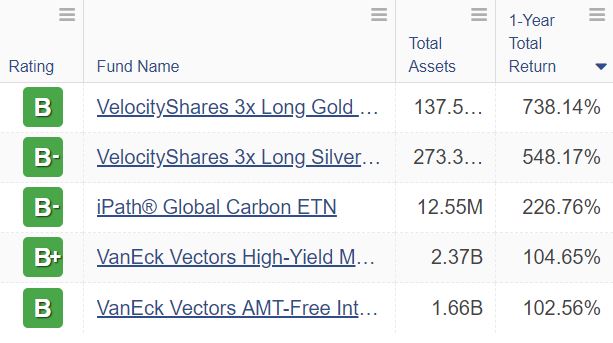

Precious-metal-related exchange-traded funds (ETFs) take top spots for best performing ETFs of 2018, with one-year total returns of 500% and higher. Natural Resources and Municipal Bonds also made the list, all with over 100% one-year total returns.

VelocityShares 3x Long Gold ETN (UGLD, Rated B) is a triple leveraged commodity ETF that focuses on gold.

This fund is rated B because it has excellent reward and currently, even as a leveraged ETF, a low risk rating. It has a three-month return of 19%, a six-month return of 920%, and a one-year total return of 730%.

VelocityShares 3x Long Silver ETN (USLV, Rated B-). Here is another triple leveraged ETF that focuses on precious metals. The index comprises futures contracts on a single commodity. The fluctuations in the values of it are intended generally to correlate with changes in the price of silver in global markets. And it came out second-best in our Weiss Ratings screener of Best One Year Return Buy ETFs.

USLV is rated a B- and has a high level of reward, This ETF has a three-month return of 15% a six-month return of 751% and a one-year total return of 521%.

iPath Global Carbon ETN (GRNTF, Rated B-) is an ETF that seeks to provide investors with exposure to the Barclays Global Carbon Index Total Return™.

This ETF is rated a B- due to very weak levels of risk. GRNTF has a three-month return of 15%, a six-month return of 67%, and a one-year return of 225%.

VanEck Vectors High-Yield Municipal Index ETF (HYD, Rated B+) is a high-yield municipal EFT that tracks the Bloomberg Barclays Municipal Custom High Yield Index.

HYD is rated a B+ and has excellent reward and fair risk. It has a three-month return of negative .51%, a six-month return of 98%, and a one-year total return of 103%.

VanEck Vectors AMT-Free Intermediate Municipal Index ETF (ITM, Rated B) is also a municipal ETF that tracks the Bloomberg Barclays AMT-Free Intermediate Continuous Municipal Index.

ITM is rated a B and has excellent reward and fair risk. It has a three-month return of 2%, a six-month return of 103%, and a one-year total return of 101%

We hope you found this list useful. Now, check out Weiss Ratings' ETF screener to see what funds you SHOULD consider investing in.