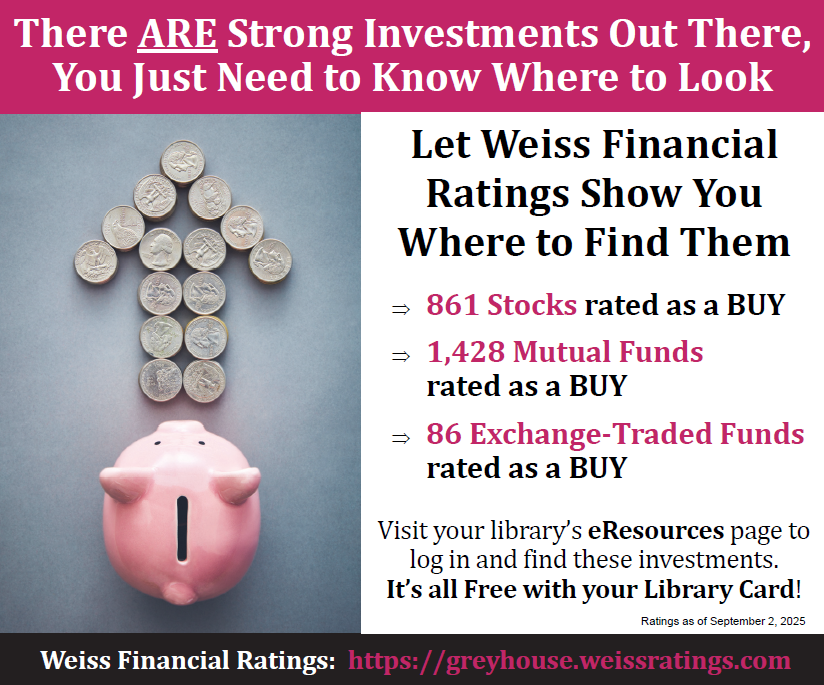

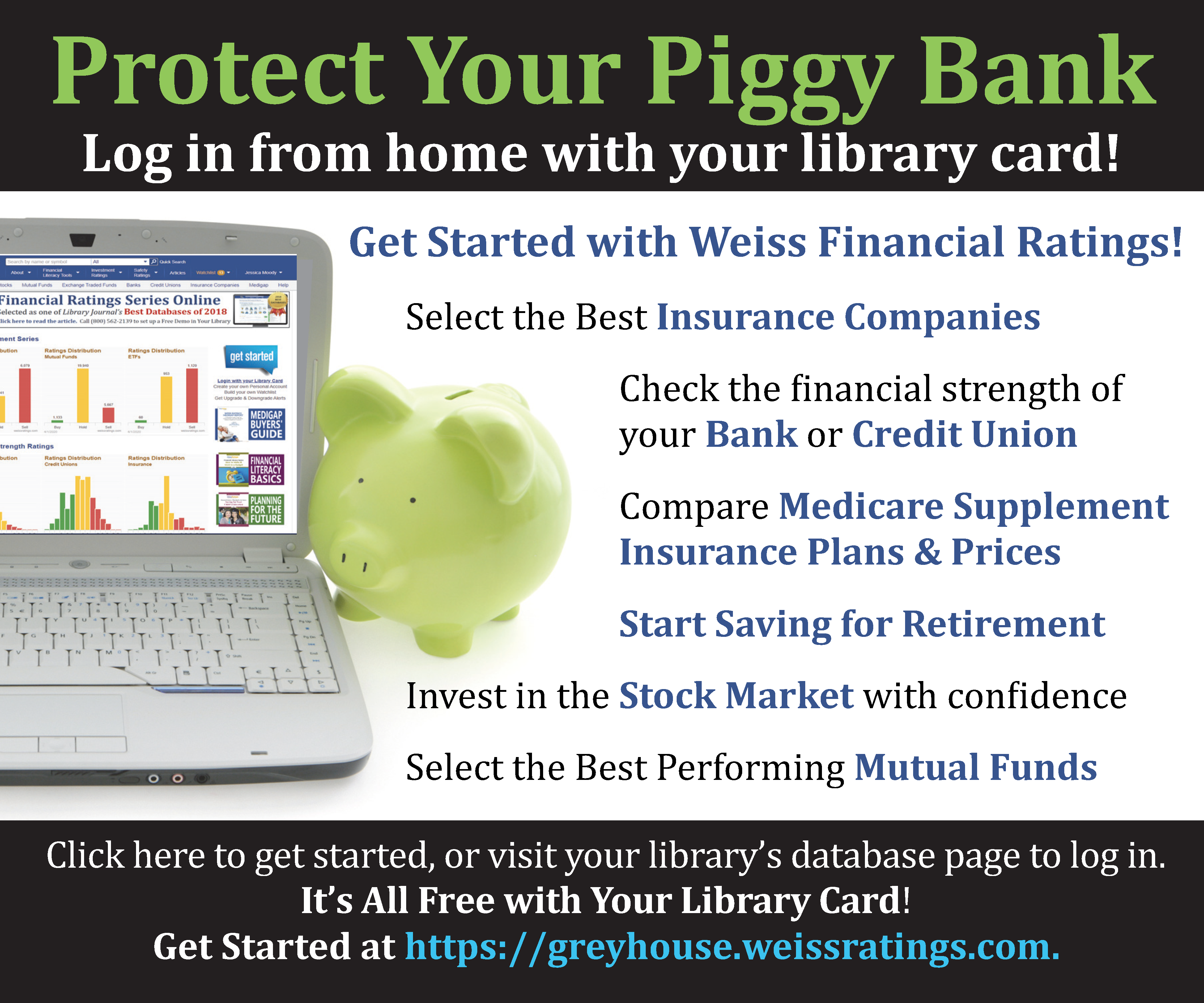

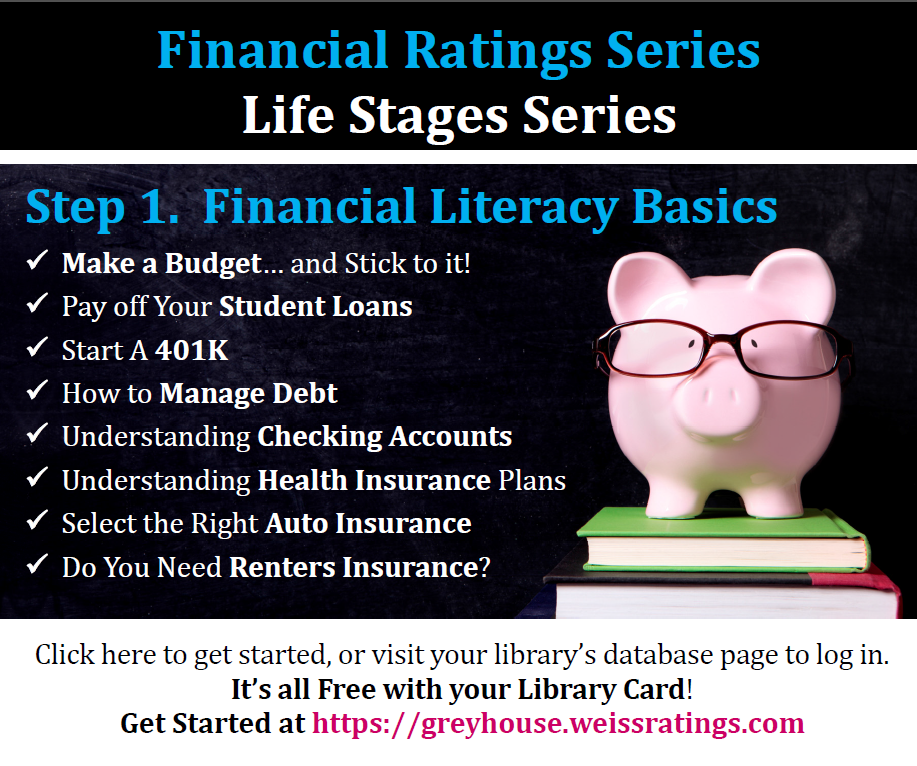

Promote Your Library's Subscription to Weiss Financial Ratings!

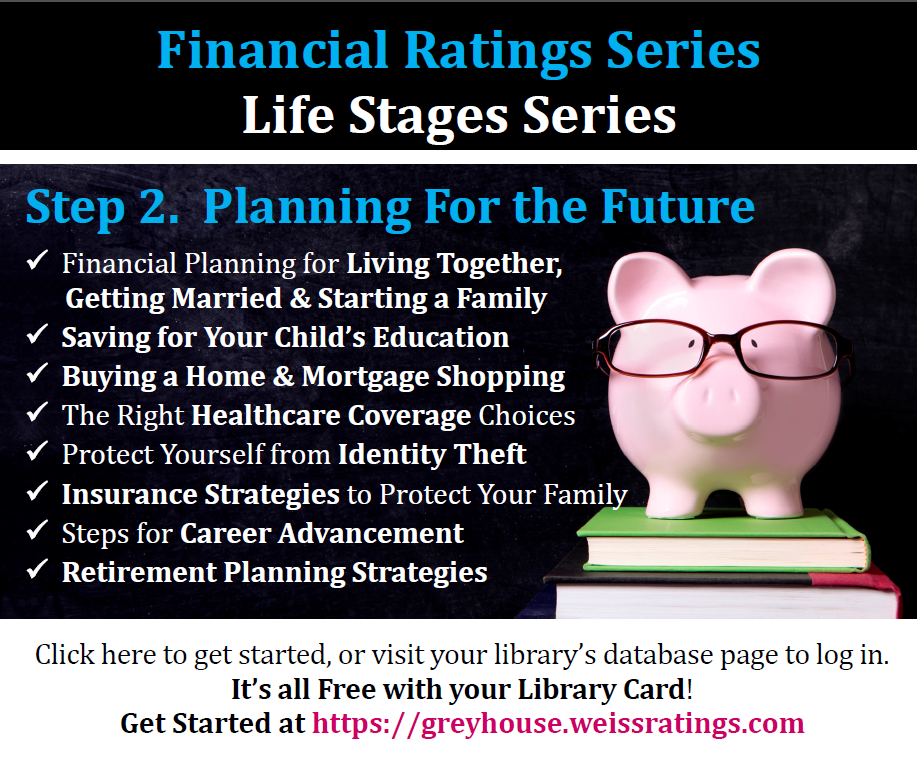

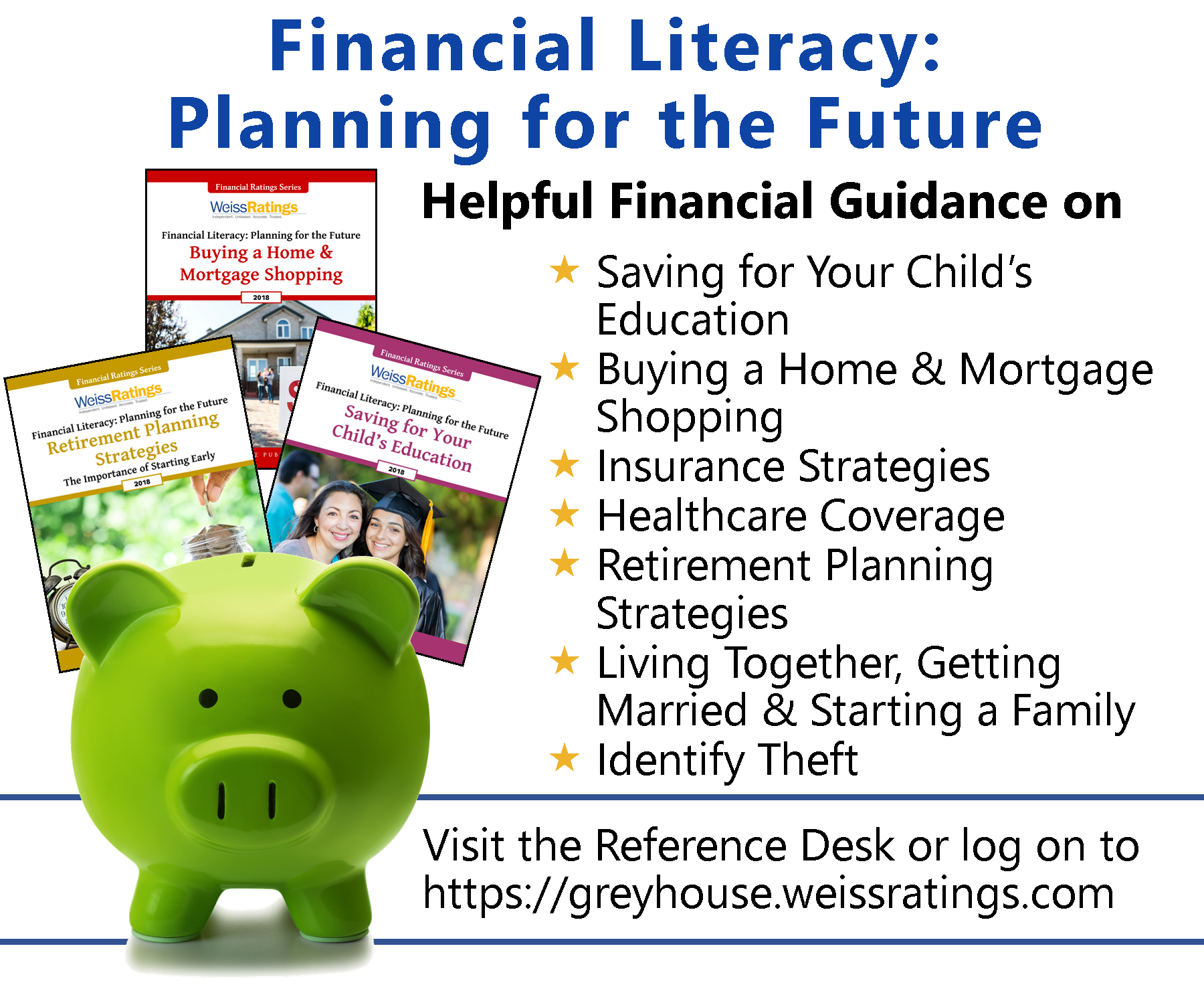

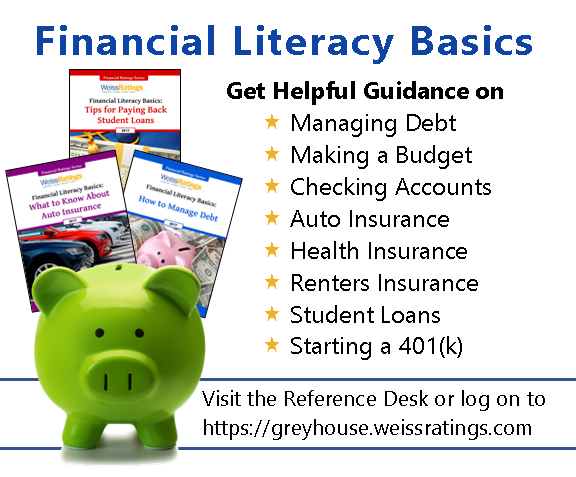

Widgets

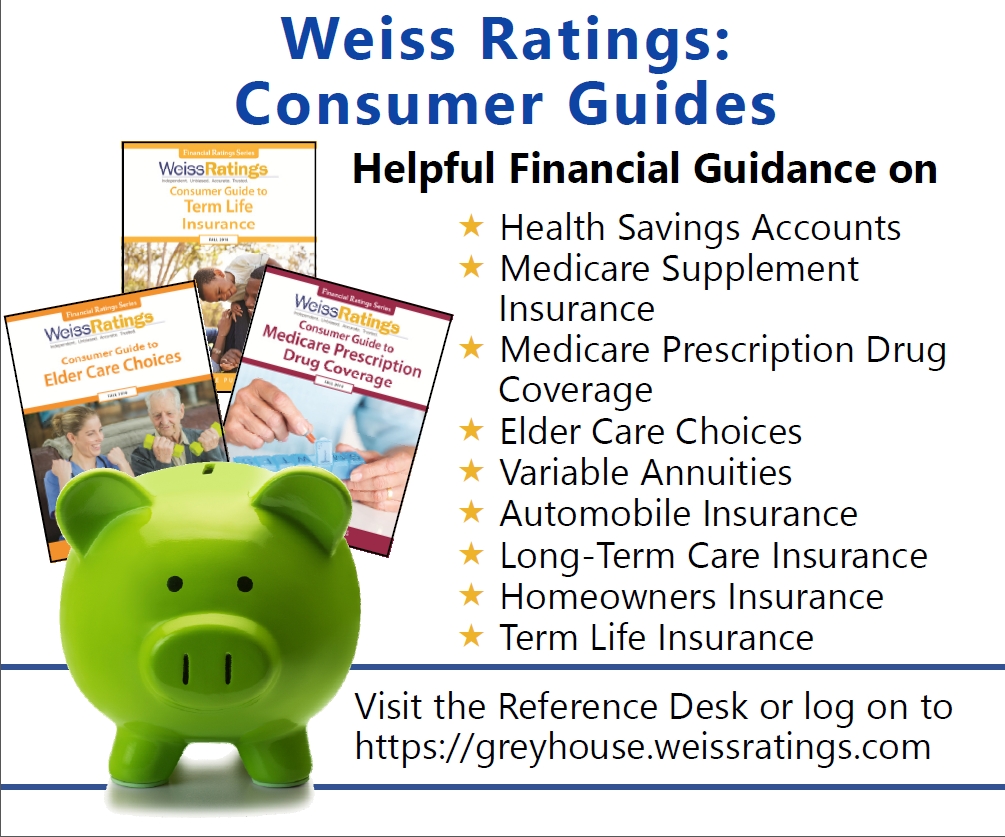

Add one of the following widgets to your library's database page.

Link your widget to https://greyhouse.weissratings.com

Looking for Medicare Supplement Insurance Widgets? Click here for more options.

| Click here to Download a High-Res PDF of all of our Widgets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.png) |

.png) |

.png) |

.png) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

You can add these videos to your library's website, use them in programming, or share them on social media to show your patrons the financial tools they have available to them with their library card!

Presentations

These longer-format videos provide patrons with helpful background information about each topic. Each video ends with a tutorial about how they can log in to the database to start searching for investments or collect their own customized Medigap report.

Medicare Supplement Insurance: How to Pick the Right Plan & Get the Best Rate

This is the code to add the video to your website:

<p><div style="position:relative;height:0;padding-bottom:56.25%"><iframe class='sproutvideo-player' src='https://videos.sproutvideo.com/embed/069fd8b41b1fe7c48f/d0b0f8c6fb7e1df5' style='position:absolute;width:100%;height:100%;left:0;top:0' frameborder='0' allowfullscreen referrerpolicy='no-referrer-when-downgrade' title='Video Player'></iframe></div></p>

A Beginner's Guide to Investing

This is the code to add the video to your website:

<p><div style="position:relative;height:0;padding-bottom:56.25%"><iframe class='sproutvideo-player' src='https://videos.sproutvideo.com/embed/709fd8b41b1be3c2f9/4d46466ae57bb15f' style='position:absolute;width:100%;height:100%;left:0;top:0' frameborder='0' allowfullscreen referrerpolicy='no-referrer-when-downgrade' title='Video Player'></iframe></div></p>

Tutorials

Each of these videos contain a short tutorial about a single section of the database. They will help patrons learn how to use a screener and find ratings for the investments or companies they're interested in.

Financial Literacy

This is the code to add the video to your website:

<p><div style="position:relative;height:0;padding-bottom:56.25%"><iframe class='sproutvideo-player' src='https://videos.sproutvideo.com/embed/a79fd8b41b1ae8cb2e/7b0a3e5ec1f26d32' style='position:absolute;width:100%;height:100%;left:0;top:0' frameborder='0' allowfullscreen referrerpolicy='no-referrer-when-downgrade' title='Video Player'></iframe></div></p>

Stocks

This is the code to add the video to your website:

<p><div style="position:relative;height:0;padding-bottom:56.25%"><iframe class='sproutvideo-player' src='https://videos.sproutvideo.com/embed/d39fd8b41b1fe2c05a/26849c9685b35db7' style='position:absolute;width:100%;height:100%;left:0;top:0' frameborder='0' allowfullscreen referrerpolicy='no-referrer-when-downgrade' title='Video Player'></iframe></div></p>

Mutual Funds

This is the code to add the video to your website:

<p><div style="position:relative;height:0;padding-bottom:56.25%"><iframe class='sproutvideo-player' src='https://videos.sproutvideo.com/embed/449fd8b41b1fe1c8cd/0da386fb7ece341a' style='position:absolute;width:100%;height:100%;left:0;top:0' frameborder='0' allowfullscreen referrerpolicy='no-referrer-when-downgrade' title='Video Player'></iframe></div></p>

Exchange-Traded Funds

This is the code to add the video to your website:

<p><div style="position:relative;height:0;padding-bottom:56.25%"><iframe class='sproutvideo-player' src='https://videos.sproutvideo.com/embed/709fd8b41b1fe1c4f9/0515e58d4b688aff' style='position:absolute;width:100%;height:100%;left:0;top:0' frameborder='0' allowfullscreen referrerpolicy='no-referrer-when-downgrade' title='Video Player'></iframe></div></p>

Banks

This is the code to add the video to your website:

<p><div style="position:relative;height:0;padding-bottom:56.25%"><iframe class='sproutvideo-player' src='https://videos.sproutvideo.com/embed/d39fd8b41b1fe1c35a/9b87fe9d882379f3' style='position:absolute;width:100%;height:100%;left:0;top:0' frameborder='0' allowfullscreen referrerpolicy='no-referrer-when-downgrade' title='Video Player'></iframe></div></p>

Credit Unions

This is the code to add the video to your website:

<p><div style="position:relative;height:0;padding-bottom:56.25%"><iframe class='sproutvideo-player' src='https://videos.sproutvideo.com/embed/709fd8b41b1fe2c7f9/22ac85f2e30b021f' style='position:absolute;width:100%;height:100%;left:0;top:0' frameborder='0' allowfullscreen referrerpolicy='no-referrer-when-downgrade' title='Video Player'></iframe></div></p>

Insurance Companies

This is the code to add the video to your website:

<p><div style="position:relative;height:0;padding-bottom:56.25%"><iframe class='sproutvideo-player' src='https://videos.sproutvideo.com/embed/ac9fd8b41b1fe1c025/8f577b2a7d9885f0' style='position:absolute;width:100%;height:100%;left:0;top:0' frameborder='0' allowfullscreen referrerpolicy='no-referrer-when-downgrade' title='Video Player'></iframe></div></p>

Add this text to your library's database page: https://greyhouse.weissratings.com

Weiss Financial Ratings Series

Important Financial Literacy Tools from Weiss Ratings & Grey House Publishing

- Independent, Unbiased Financial Strength Ratings of Banks, Credit Unions & Insurance Companies

- Conservative Buy-Hold-Sell Ratings of Thousands of Stocks, Mutual Funds & Exchange Traded Funds

- Create your own Personal Account to create a Watchlist, get Upgrade/Downgrade Notifications and Log In from Anywhere

- Medicare Supplement Insurance - Which Plan to Choose, How Much it will Cost, Compare Rates & Plan Benefits

CLICK HERE to take advantage of these important financial planning tools today!

Submit a Press Release to your Local Newspaper to promote your subscription to Financial Ratings Series to your community.

Financial Ratings Series Online

Medicare Supplement Insurance Buyers Guide

Program Ideas: Help Increase Financial Literacy in your Community

Many libraries are looking at helping to increase the financial literacy in their communities. Financial Literacy Basics makes a great foundation for an 8 week “Adulting 101” or “Life-ing 101” program. The books provide straight forward information along with handy worksheets for patrons to use.

Partnering with your local Chamber of Commerce can make the job of presenting even easier!

-Pair up with a local Realtor to talk about the process of looking for an apartment or house to rent along with the application process. This leads nicely into talking about renter’s insurance and utilizing that guide.

-An important part of the application process is credit history. The next week you can pair up with a local Accountant to talk about budgeting and how to make a helpful budget along with pairing up worksheets from the How to Make and Stick to a Budget guide.

-You can extend the partnership with the Accountant a second week to talk about Managing Debt and utilizing THAT guide.

-Pair up with a local bank or credit union and utilize the Checking Account guide to help guide your patrons through the process of maintaining and managing a checking account.

-Have a local mechanic come in and show people how to change a tire and check their oil. They can also help with questions to ask and things to look for when hiring a mechanic. Pair this with the guide to Auto Insurance.

-Have a local financial advisor talk about investing and some ways to start. Pair with the Guide on 401k’s.

-Have a local Insurance agent talk about the process of choosing health insurance and how to navigate the Marketplace during open enrollment. Utilize the Guide to Health Insurance for helpful tips and worksheets.

-A local college or high school counselor can help talk about estimating costs for college, FAFSA paperwork and due dates, applying for college, tips on writing your college essay and you can use the Guide to Student Loans for other helpful information.

Program Ideas: Check the Rating of Your BankWe check reviews for many things… items we are going to purchase online, suggestions on contractors, reviews on cars, hotels, restaurants, etc…

We take these comments and reviews into consideration before we SPEND our money, BUT...

HOW MANY PEOPLE HAVE THOUGHT TO CHECK ON THE FINANCIAL STRENGTH OF WHERE THEY KEEP THEIR MONEY??

How many people knew that they could??? A lot of people DON’T know they can do this!

Weiss Financial Ratings has a 98% success over the last 10 years in predicting banking institution failures. We are Independent, Unbiased, and Conservative in our ratings. It is information you can trust.

EVERYONE should know the financial strength of where they keep their money (and the companies they “invest” in!)

EVERYONE benefits from this information! People with a personal account at a bank, someone with a local small business account or someone looking to start a home-based business, EVEN the High School student looking to open their first checking account for their part-time job earnings! They all have choices of where to put that hard-earned money.

Let your local Chamber of Commerce know that you have this information for their members!

If your local High School has a Personal Finance class for its students, let the teachers know that you have this information. It can help supplement their material when they start talking about checking accounts. As these students get summer jobs, or come in looking for summer job help/advice, take a moment to let them know that you have some helpful information for that new income.

You can help!!

...now, if you haven’t already, go check on the rating of YOUR bank/credit union!