Still MORE Banks at Risk

I have an urgent message and an equally urgent, today-only recommendation. But first the facts …

Based on year-end 2022 data, our Bank Safety Ratings showed there were close to 4,250 banks and credit unions at present or future risk of failure.

That was both shocking and controversial.

Now, there are 5,274.

That’s bound to be even more shocking and controversial.

So, let me take this opportunity to provide full disclosure of our methodology and philosophy.

First and foremost, we’re not here to protect the banks or make mealy-mouthed excuses for bad management and government meddling. That’s their “job.”

Our job is to help protect the customer and the investor. That’s why we never have accepted — and never will accept — payment from the institutions for our ratings.

The data comes from the FDIC. They’re the ones who collect quarterly reports from the banks and then provide the data to research or ratings firms like ours.

Then our computer models crunch the data and generate the ratings. No bias. No second-guessing or cherry-picking. It is what it is.

But built into our models is our view of what’s important, what’s safe and what’s not safe. So, at the end of the day, our rating is an expression of our opinion.

Other analysts are free to have their opinions, and if they differ from ours, we can have a reasoned debate about who’s on target or who’s not.

Then, let history be the judge.

Opinions are also tied to goals. So, let me say it again: Our goal is to protect the bank customer and investor.

And with rare exception, they tell us the last thing they want is to get caught up in a bank failure.

Why?

Because they don’t want their mortgage sold off to another institution or their line of credit canceled.

They don’t want to wait in line for their money.

They don’t want to lose money.

They don’t even want to lose sleep over the possibility that they might lose money.

And they have a choice.

They can go to a safer bank across the street. They can bank online with some of the safest in the country.

Or they can do most of their banking with a money market mutual fund that discloses exactly where the money’s going, never makes high-risk loans and pays better yields.

So, if we’re going to err (a human quality), we want to err in their favor. Not in favor of the banks.

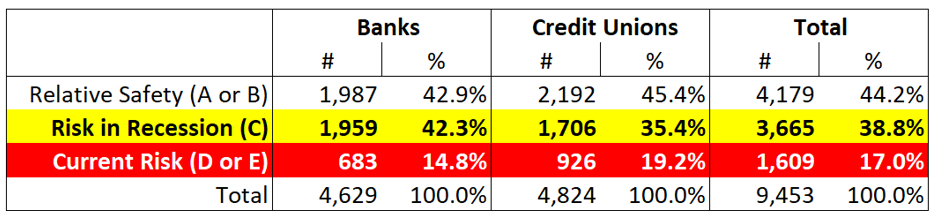

That’s where we’re coming from. And the chart below shows the results based on FDIC data as of March 31, 2023:

Most Banks and Credit Unions at Risk of Failure

The key takeaways:

• We’re issuing a yellow-flag warning on 3,665 banks and credit unions, or 38.8% of the depository institutions we rate. These get C ratings (C+, C or C-), which means they will be at risk of failure in a recession or a deeper financial crisis.

• We’re issuing a red-flag warning on 1,609 banks and credit unions, or 17% of the institutions we rate. These get D and E ratings, which means they’re currently at risk of failure.

• In total, 5,274 banks and credit unions (55.8% of all institutions) are, or could be, at risk.

Important: At risk of failure does not mean “will fail.” In fact, in normal times, most at-risk banks do not fail, either thanks to their own efforts or government intervention.

What might happen if those efforts or interventions themselves fail, as they did in the 1930s, is another question entirely — something I will cover next time.

For now, here’s what I think you should do:

Step 1. If you have an account or do business with a bank or credit union, go to the bank safety division of our website.

Step 2. At the top of the page enter your bank name in the search bar. (See image below.). If there’s more than one bank with the same or similar name, seek to identify yours by its state of domicile.

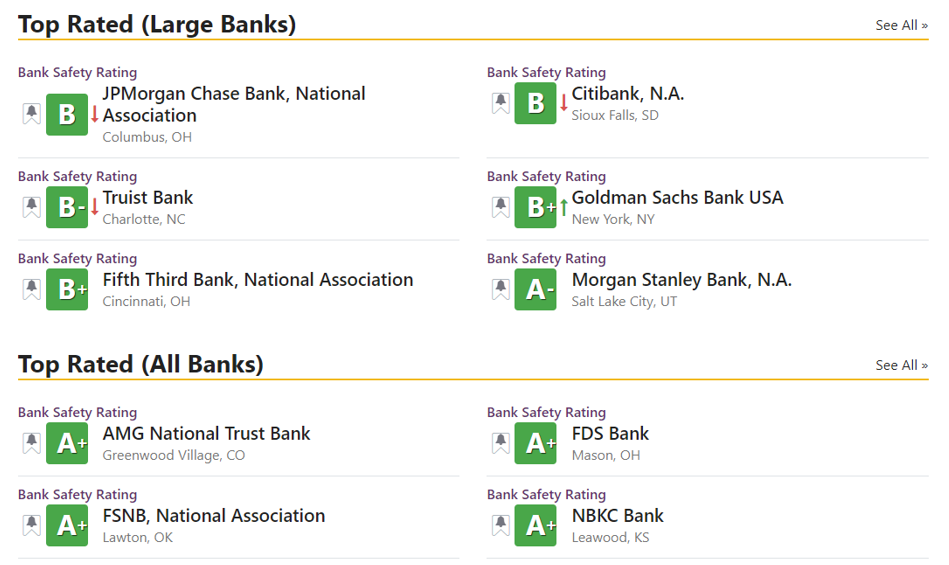

Step 3. If it gets one of our C ratings, consider moving to a safer institution, especially if you’re in agreement with our forecast that the economic and financial environment is bound to worsen from here.

If it gets one of our D or E ratings, I recommend moving your funds to a safer institution now. For lists of our top-rated banks and credit unions, scroll down on the same page. (See image below.)

Good luck!

Martin D. Weiss, PhD

Weiss Ratings Founder