With Consumer Spending Strong, These are the Kinds of Stocks to Target

|

Some forecasters should pay more attention to American consumers' spending habits. If they did, they'd know shoppers are still spending generously and powering the U.S. economy ever higher.

"The bottom line is that consumer spending remained resilient in August and continued to be a key contributor to U.S. economic growth," said Jack Kleinhenz, the chief economist at the National Retail Federation.

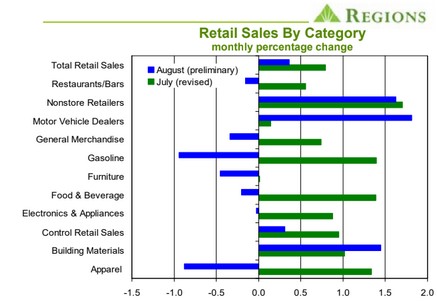

Specifically, retail sales rose by 0.4% in August, besting the consensus forecast of a 0.3% increase. The gains were led by online retailers, autos, and building materials. In dollar terms, Americans spent a total of $469 billion in the month of August!

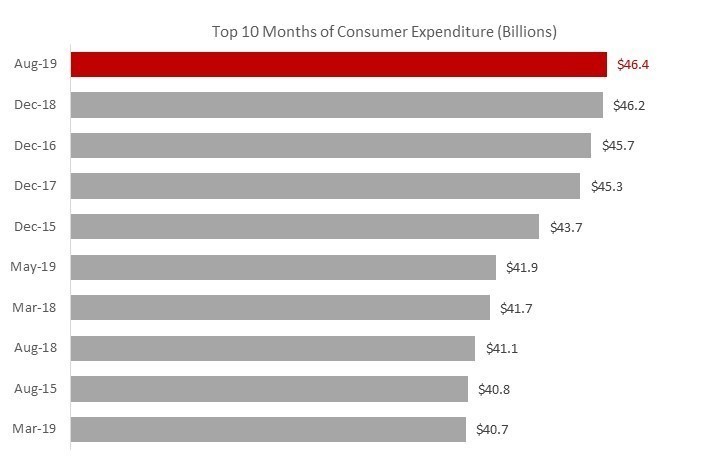

Not only that, but according to J.D. Power & Associates, August showed the strongest year-over-year retail spending gain since December 2016.

|

Moreover, the July retail sales number was upwardly revised from a 0.7% gain to an 0.8% increase.

Plain and simple, the strong consumer spending numbers are being driven by a 1) strong jobs market and 2) increasing wage growth.

Why is this so important? Because the U.S. is a consumer-driven economy! That’s why I expect Q3 to be another strong quarter of economic growth. As was the case in the second quarter, robust consumer spending should continue to power our economy higher .

If you're an ETF-type of investor and want to profit from the retail spending boom, you should consider one of the three largest (by assets) retail-focused ETFs:

- SPDR S&P Retail ETF (XRT)

- Amplify Online Retail ETF (IBUY)

- VanEck Vectors Retail ETF (RTH)

|

However, I think you can do much better with a targeted approach – one in which you invest in the most robust parts of the consumer spending food chain.

I say that because the retail world seems to be divided among the “haves” and the “have-nots”.

Last month, six of the 11 major retail categories were negative, including general merchandise stores, gasoline stations, furniture, and apparel.

That's a stark contrast, for example, to the 16% annualized increase in online retail sales.

The problem is that the above-mentioned retail ETFs invest just as much into those struggling retailers as the healthy retailers, which is where the Weiss Ratings Screener can help you. With our Screeners, you can zero in on only the highest-rated consumer services stocks — those with Weiss Ratings in the “A” category vs. those further down the letter scale. And it won’t cost you anything to do so!

Here are the top five stocks in the consumer services industry recently …

|

They include Choice Hotels (CHH), Pollard Banknote (Toronto Stock Exchange: PBL), The Wendy's Company (WEN), Dunkin' Brands (DNKN) and McDonald's (MCD). As you can see, the list includes many well-known hotel and restaurant chain operators, among other names.

That doesn't mean you should rush out and buy those stocks tomorrow morning. As always, you need to do your own research before you invest. But the above five stocks have the strongest fundamentals and underlying technical strength, according to our stock analysis model.

So, it’s worth your time to start there if you’re looking for ways to profit from stronger consumer spending.

Best wishes,

Tony Sagami