Why Uranium Could Be 2020's Big Trend in Energy

|

There are a bunch of stocks in the deep freeze right now that should thaw in the coming decade. But for now, I want to give you a sneak peek, and tell you about one trend poised to heat up so much, it’ll glow in the dark.

I’m talking about uranium miners.

I like megatrends — massive, long-term shifts that can reshape markets. And it sure looks like a megatrend is shaping up in uranium right now.

There are many forces lining up to push the price of this energy metal higher. Here are my top five ...

Force 1. Rising demand.

Global demand for triuranium octoxide (U3O8), the stable form of uranium oxide that is traded around the world, should rise 3.1% annually through 2025.

Why? Well, new nuclear power plants are being built, and the old ones are getting license extensions.

World nuclear generating capacity was 398 gigawatts electrical output (GWe) in 2018. That is expected to rise to 462 GWe by 2030 and 569 GWe in 2040. Globally, 454 reactors are running, 54 reactors are under construction, and more are planned.

Force 2. ‘Mind the gap.’

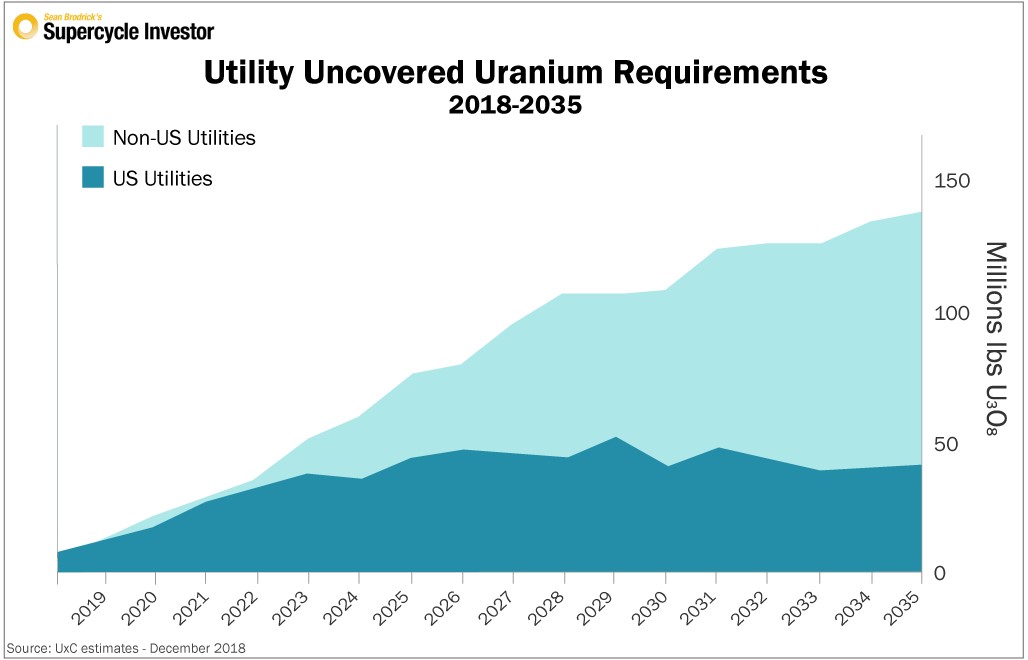

Although the utility demand for uranium is increasing fast, utilities have put off buying the uranium they need. According to industry experts at UxC, cumulative uncovered uranium requirements are about 1.9 billion pounds to the end of 2035.

|

Utilities have put off buying uranium because prices in the spot market went down month after month for years.

Prices have finally stopped going down, but they haven’t rallied sustainably. Not yet.

Once a real rally starts, I believe that buying by utilities with hungry reactors to feed could drive the price through the roof!

Force 3. Next Year’s Bull Market.

Many experts believe the market could tighten significantly next year, and potentially even go into shortage. This is significant because uranium is a market where supply is secured years ahead of time — at least two years for long-term agreements, and at least a year and a half for spot market purchases.

Only around 67% of European and 28% of U.S. utilities’ 2024 uranium requirements are currently contracted. The clock is ticking on covering those gaps. And if supplies remain tight — and it sure looks like they will — the price is likely to go higher in a hurry.

Force 4. The Price is Way too Cheap.

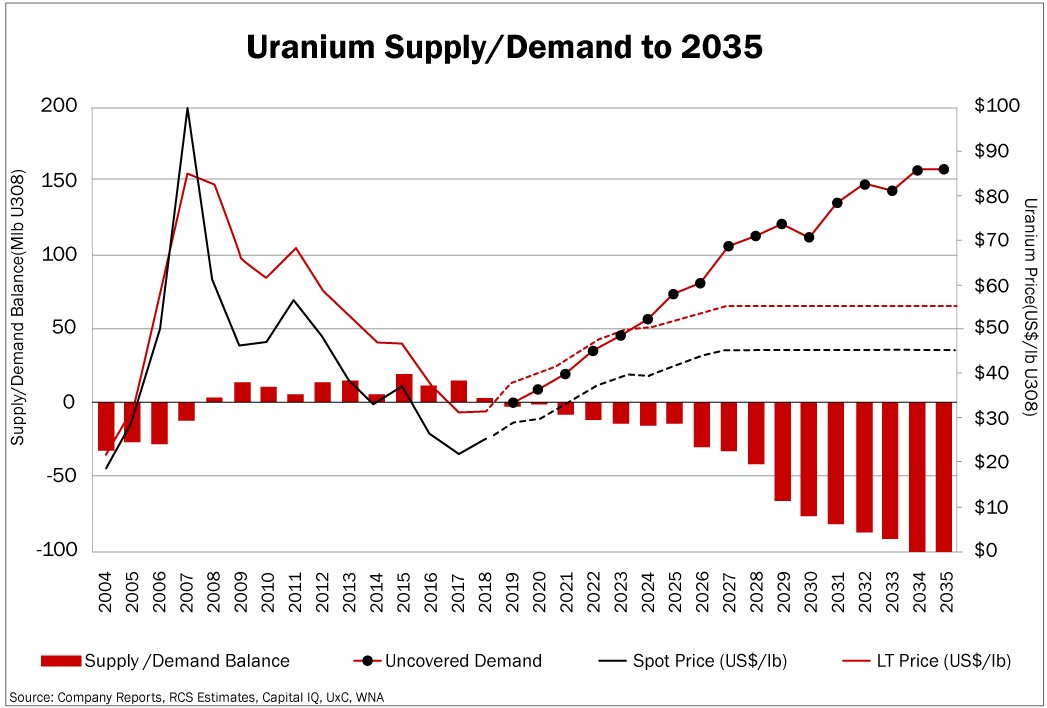

Most new mine supply that could come online in the next cycle requires a base price of $55 per pound. The recent price of uranium was $25.95, and it has zig-zagged around there since February.

In fact, according to experts at Red Cloud Securities, the price of uranium should go much, much higher over the longer term.

|

|

Source: RedCloud Securities |

That sure looks like a megatrend to me.

Force 5. Government Action.

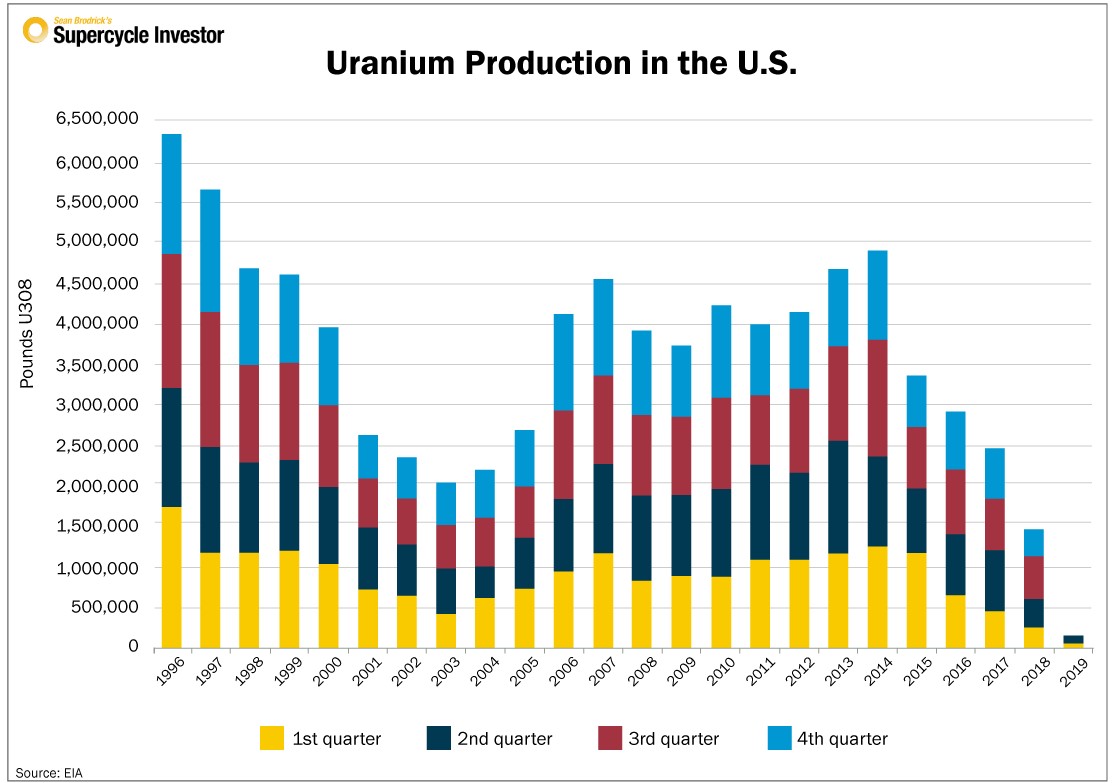

About 90% of America’s uranium fuel is imported. This is because production in the U.S. and Canada has been undercut by oversupply from Russia and Kazakhstan. As a result, U.S. production of uranium has fallen drastically.

This chart from the Energy Information Administration is a tale of woe ...

|

Following a complaint filed under Section 232 of the Trade Expansion Act, President Trump's Nuclear Fuel Working Group is now recommending the U.S. Department of Defense purchase more uranium from domestic producers.

It also recommends potentially creating a new national uranium stockpile.

In other words, this could be just the ignition that the U.S. uranium market needs.

There are two U.S. uranium producers — Energy Fuels (NYSE: UUUU) and UR-Energy (NYSE: URG). They’re trading as penny stocks now. They could have bright futures.

In the meantime, I can tell you an easy way to play this market: The Global X Uranium ETF (NYSE: URA).

It has a total expense ratio of 0.69%, and it holds important names like the Uranium Participation Corp. (OTC Pink: URPTF), a fund that holds physical uranium; Cameco Corp. (NYSE: CCJ), a big Canadian uranium miner; ITOCHU Corp. (ITOCY), which is in the nuclear fuel business; and NexGen Energy (NYSE: NXE), a uranium explorer.

A fund like URA won’t have the potential upside of individual stocks. But it also has less potential downside than uranium penny stocks. So, it’s a good choice for casual investors who want some uranium exposure.

Still, be sure to do your own due diligence before you buy anything.

The last uranium bull market was over a decade ago. But like most metals, it’s cyclical. And uranium prices should heat up going forward.

I think we’ll see a white-hot 2020.

You should come along for what could be a rocket ride.

All the best

Sean