Is a Gold Breakout Waiting in Santa’s Sleigh?

The stock market is itching for a Santa Claus rally. You can feel it. But I think you should keep an eye peeled for a rally of a different kind — a rally in gold.

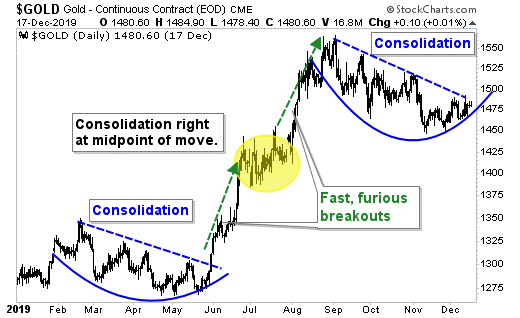

Let me show you a chart of gold’s action in 2019 ...

|

You can see that the yellow metal was in the dumps as the year started. And it continued to grind along until May 31. Then ... Bang! Zoom! Gold soared over $1,400.

That led to another, month-long consolidation. Then gold zoomed higher again. It didn’t peak until $1,566 on Sept. 4.

Now, we’ve had MORE months of consolidation. What do you think happens next?

Folks, we’ve seen this movie. It’s a re-run. Gold is primed for blast-off.

Now, the blast-off doesn’t have to happen over Christmas. But it wouldn’t surprise me. The markets are so thinly traded — with many traders being away — that low-volume environment is a gasoline-soaked launchpad for potential moves.

If gold does blast off, $1,566 becomes the obvious first target. But if you look at what happened earlier in the year, gold surged 5.7% in a short period of time before consolidating again. Such a move would bring gold to $1,655 very quickly.

And gold’s eventual peak in September was 15% above the peak it made in February. That would give us a target of $1,800.

That’s a nice round number, don’t you think?

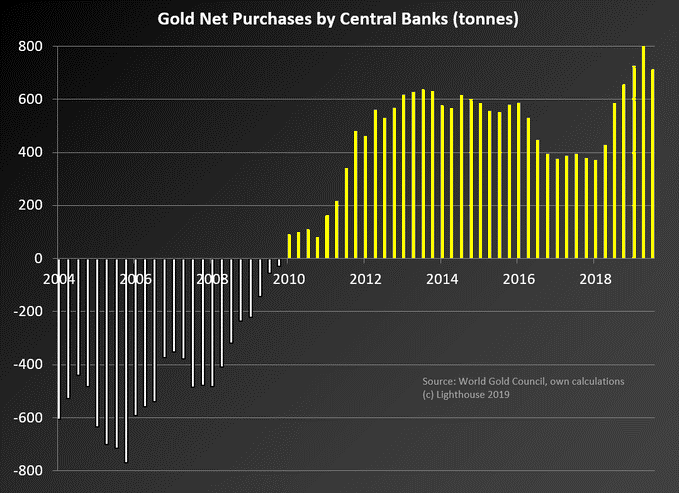

What would drive gold to those levels? The same things I’ve told you about before: Ultra-accommodative central banks. Geopolitical turmoil. Stresses on the global financial system. Central bank buying. I have a chart that shows the surge in central bank buying in recent years ...

|

|

Source: World Gold Council/MacroTourist |

In fact, while full-year numbers aren’t in yet, 2019 is on track to be a 50-YEAR-HIGH in central banks’ net gold purchases. Central banks are on track to buy a record 750 metric tons (24 million troy ounces) of gold this year. They could buy even more next year.

All told, central banks are gobbling up about 20% of supply coming out of the world’s gold mines. Wow! That’s a lot of metal.

So WHY do you suppose Central Banks want to buy so much gold?

I don’t know. It’s a surprise. Maybe a Christmas surprise.

Are You Getting Gold in Your Stocking?

As I showed you, it wouldn’t surprise me to see the rally start very soon. Maybe when Christmas bells are jingling.

All the best,

Sean