Insiders Are Buying With Both Hands. Should You?

Oh my gosh, financial news is scary now.

• Fox Business host Maria Bartiromo worried aloud on "America’s Newsroom" that recession cries are "getting louder."

• Bloomberg says, “recession fears are rising around the world.”

• CNN says, “there is a growing sense of crises piling on crises” that has “distilled a sense of pessimism and exhaustion among the American people,” and naturally, this is driving investors to “sell, sell, SELL!” as Jim Cramer might say.

You know who’s not worried? Insiders.

And I say that because they’re buying their own stocks hand over fist.

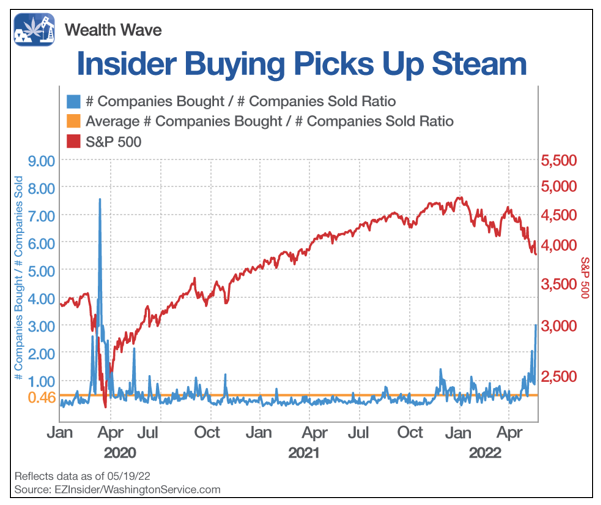

Take a look at this chart made with data from The Washington Service:

Yeah, insider buying of stocks is surging. The blue line shows the daily ratio of buying to selling among company insiders. More insiders have purchased than sold for the first time since March 2020, for an insider buy/sell ratio of 1.03.

For example, on a recent day, there were three times as many companies with buying activity than selling activity. Nice!

I can tell you that there are all sorts of reasons for insiders to sell. But there’s only one reason for them to buy: They believe their stock is going higher.

To be sure, the stock market is not the economy. But it’s not immune to it, either.

And it’s safe to draw the conclusion that if insiders are buying, Main Street investors should do the same. That is, if they want to own stocks that are going up.

So, how can you look at insider buying trends? There are some great FREE websites that do it for you:

• Openinsider.com is a website we use at Weiss in our own research to find stocks where clusters of insiders are buying.

• finviz.com is another website I use. It has a database of the latest insider trading.

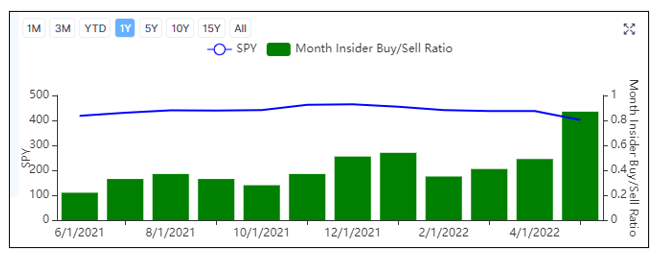

• GuruFocus.com has a free summary and searchable database of insider filings. You can register for free to get access to more features. And the chart accessible on that page confirms that the monthly buy/sell ratio is going higher.

Holy Jolly Green Giant, look at the size of that candle on the right!

Sure, insider buying certainly doesn’t rule out a recession. We’ll have one eventually, because economies are cyclical. However, a recession might be a lot further down the road than the babblers on TV would have you believe.

Importantly, insider buying doesn’t guarantee the market is going higher. On the other hand, it sure helps.

I could tell you all the good things happening in the economy that insiders might be looking at — including a jobless rate at 50-year lows, higher pay (that may or may not keep up with inflation) and a splurge in travel spending despite high gasoline prices.

But then, I wouldn’t want to make all those doomsayers look like complete fools, would I? After all, they do a fine enough job of that on their own.

If I were you, I might use one of those screeners I linked above and get busy. Just remember two things I keep pounding the table about:

1. A new commodity bull market began in 2020 and probably has years to run.

2. And the rotation from growth to value in the stock market is ongoing and probably accelerating.

Keep that in mind when you’re picking stocks and doing your own due diligence, as always.

All the best,

Sean