How to Invest in Red-Hot ‘Meme’ Stocks and High-Flying ETFs

|

“Stonks” only go higher, right?

That’s the main takeaway from the craze around red-hot names like GameStop Corp. (NYSE: GME) and AMC Entertainment Holdings, Inc. (NYSE: AMC), popularized by the Reddit day-trading crowd.

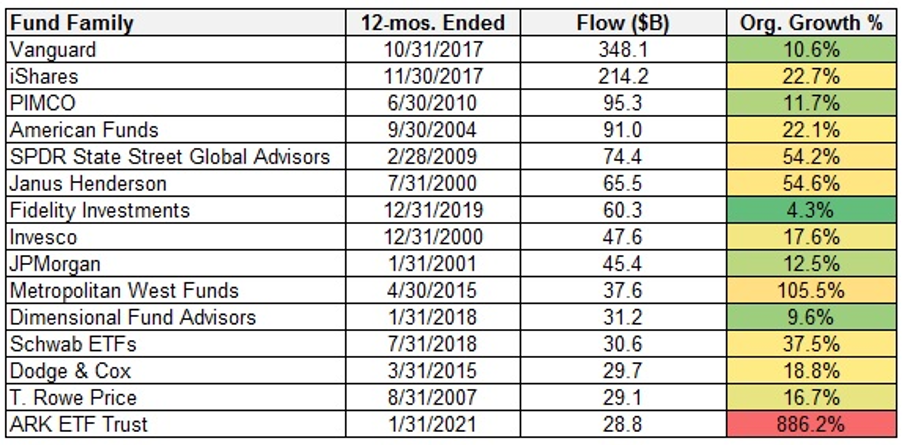

Almost as frenzied is the action around the ARK Investment Management family of exchanged-traded funds (ETFs). Investors are plowing money into them at a pace never seen before.

In fact, investors have never poured so much money at such as furious pace.

Over the last 12 months, investors have thrown $28.8 billion into ARK ETFs. That’s the 15th-largest raw-dollar inflow of all time. But it’s No. 1 in terms of percentage growth: 886%.

|

| Source: pbs.twimg |

Total ETF assets for the company are now at $53 Billion.

The ARK Innovation ETF (NYSE: ARKK) is ARK’s most popular ETF with net assets of $23 billion. Its other four ETFs are no slouches:

• ARK Genomic Revolution ETF (NYSE: ARKG), with $10 billion in assets, is up 173% in the last 12 months;

• ARK Next Generation Internet ETF (NYSE: ARKW), with $6.5 billion in assets, is up 152% in the last 12 months;

• ARK Autonomous Technology & Robotics ETF (NYSE: ARKQ), with $2.8 billion in assets, is up 122% in the last 12 months; and

• ARK Fintech Innovation ETF (NYSE: ARKF), with $2.7 billion in assets, is up 120% in the last 12 months.

Every one of the ARK ETFs have more than doubled in the last 12 months. Given that success, a small army of investors is following the moves ARK makes, using its daily purchases as its own shopping list.

|

| Source: cms.qz.com |

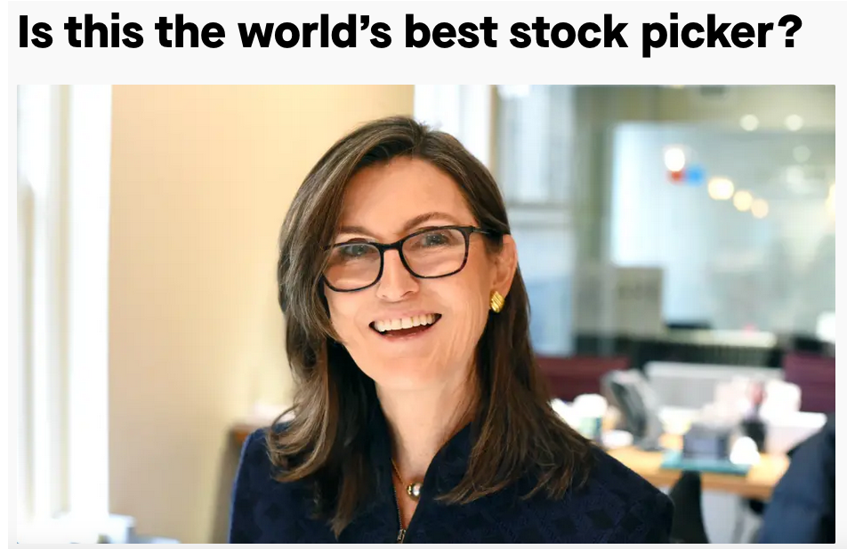

People are even beginning to ask whether Cathie Wood is “the world’s best stock picker” because of her early (and loud) recommendations of other headline-generating names like Tesla, Inc. (Nasdaq: TSLA), Square Inc. (NYSE: SQ), Shopify Inc. (NYSE: SHOP) and Bitcoin.

|

| Source: cms.qz. |

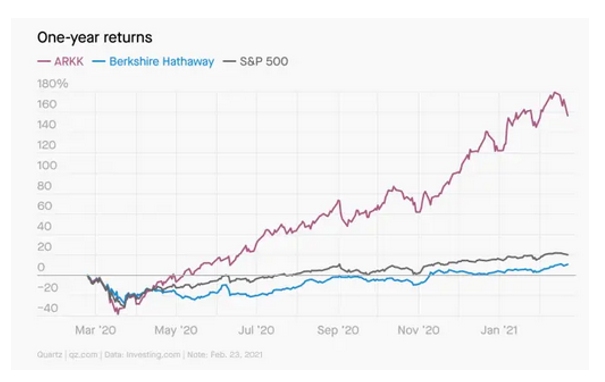

ARK Innovation ETF has smashed the performance of the S&P 500 Index and trounced icons like Warren Buffett.

And, I have to admit, I envy her 2020 performance.

The key to ARK’s stellar performance is its focus on five key “disruptive” technologies: artificial intelligence (AI), energy storage, robotics, DNA sequencing and blockchain technology.

I absolutely agree about AI, robotics, energy storage and blockchain technology. I don’t share the enthusiasm for DNA sequencing simply because I lack the medical background to make intelligent decisions.

Should you add a little ARK spice to your portfolio? There’s no denying its stellar performance. But its ETFs are volatile.

ARK Innovation ETF has a standard deviation of 35.8% compared to 12.1% for the S&P 500, which means it’s almost 300% more volatile than the world’s most widely followed equity index.

And the Weiss Ratings gives ARKK a “D+” for risk.

My experience is that investors who absolutely love volatility to the upside also absolutely hate volatility to the downside.

If you have a cast-iron stomach and a long-term horizon, I think the ARK funds are worth your consideration.

But buckle your seatbelt; it will be a wild ride.

Best,

Tony