Four Charts that Show Why Marrying Fundamentals AND Technicals is the Way to Go

I want to start today’s column by showing you four charts – each of which illustrates the results from a different investment strategy. The red line in these charts shows the back-tested results from each strategy, while the green line shows the performance of the S&P 500 during the same time period.

Since I started the clock in January 2010, not long after the current bull market began, the S&P 500 did quite well – up 141.1%. But could you have done even better … or worse … by taking a different investment approach? See for yourself …

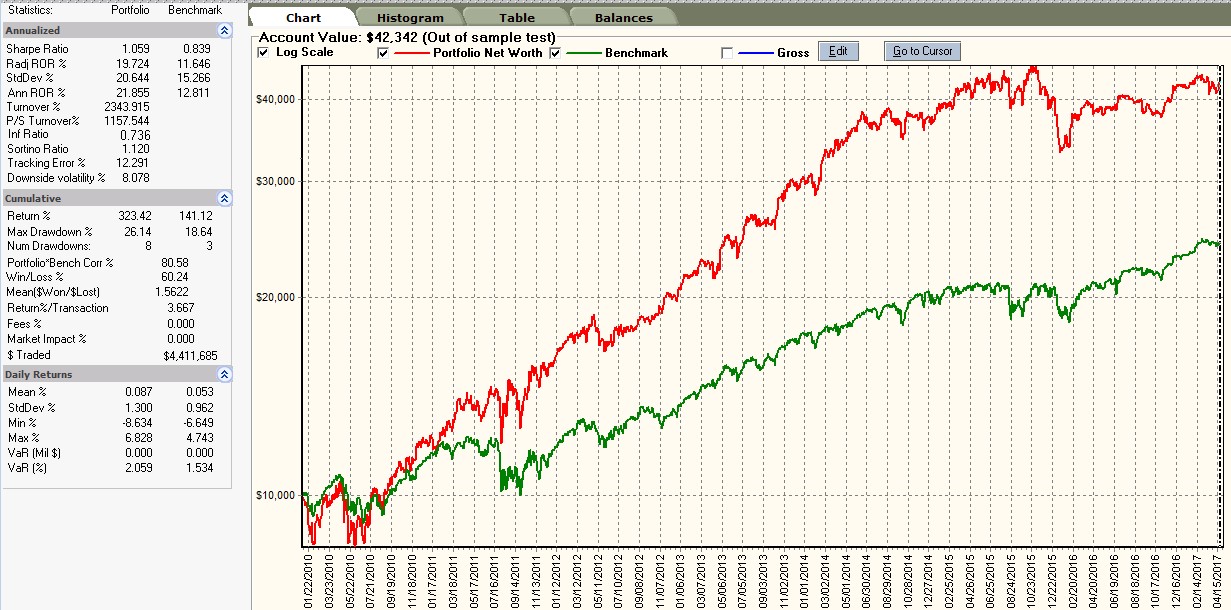

Strategy #1:

Back-Tested Gain: 323.4%

Relative Performance Vs. S&P 500: +182.3 percentage points

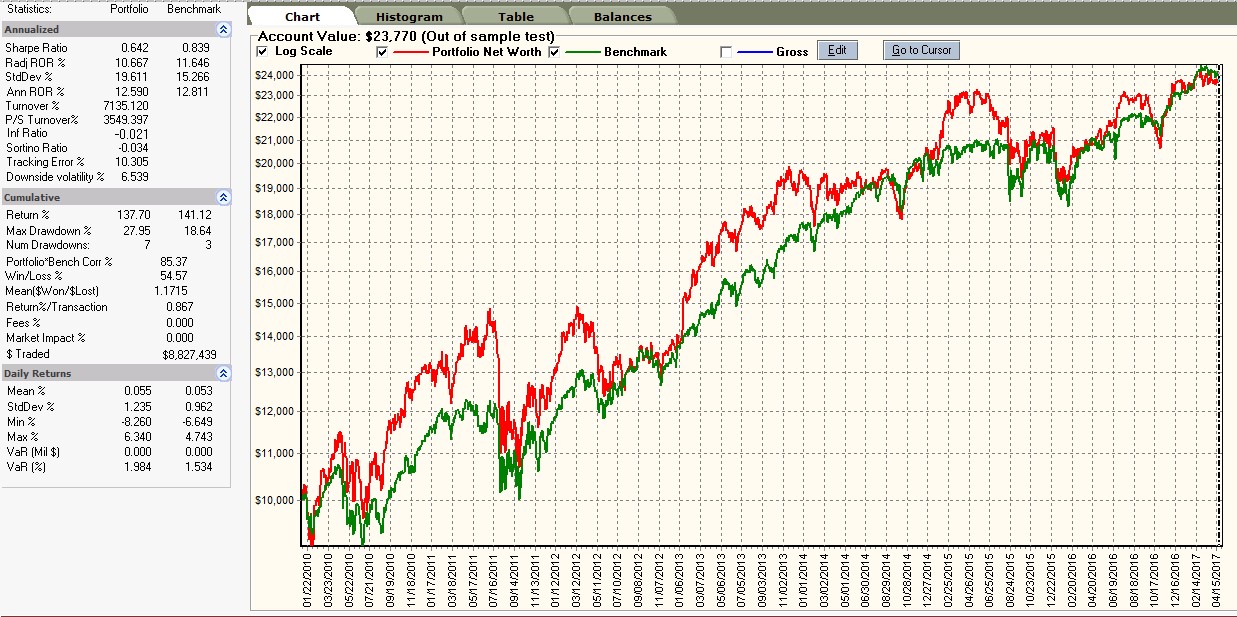

Strategy #2:

Gain: 137.7%

Relative Performance: -3.4 points

Strategy #3:

Gain: 100.4%

Relative Performance: -40.7 points

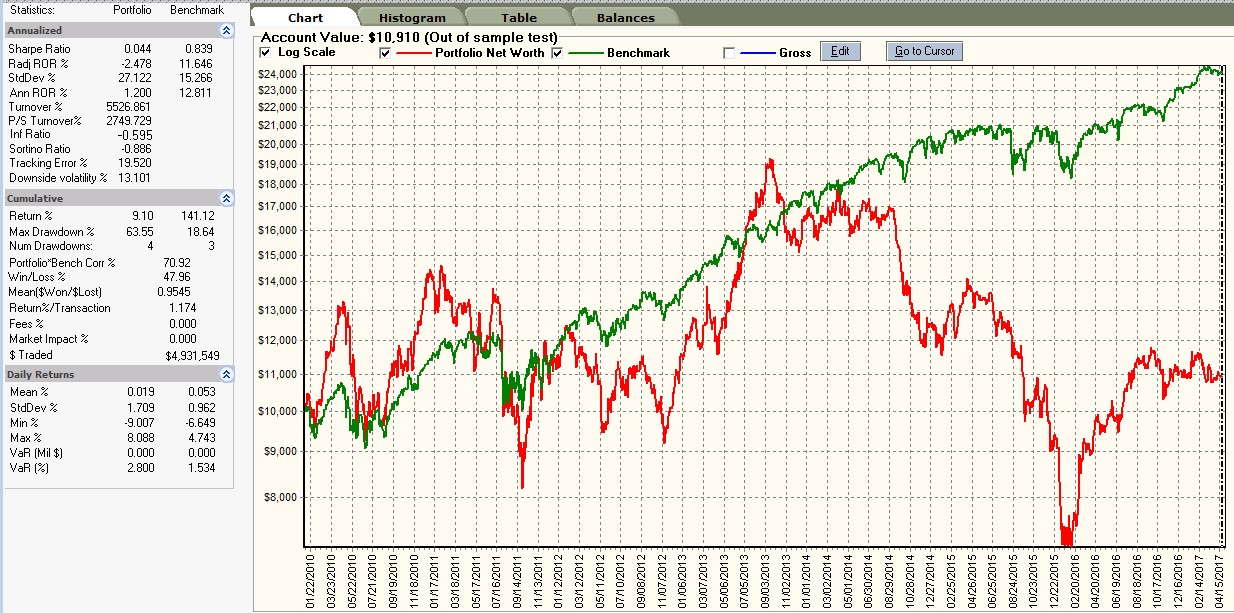

Strategy #4:

Gain: 9.1%

Relative Performance: -132 points

I don’t know about you. But it seems pretty obvious to me which choice would’ve made the most sense. You could’ve trounced the S&P 500 with Strategy #1, earning a return more than twice as great as you would’ve from a passive index approach. On the flip side, you could’ve made very little money at all with Strategy #4 – barely eking out 9% at a time when the markets were on fire.

Well, guess what? The first strategy was based on relatively simple rules: Buy the top 10 stocks among all of those rated “A” (BUY) by Weiss Ratings, then rebalance weekly. I specifically excluded stocks with less than 50,000 shares in 30-day average trading volume, and those with market caps of less than $50 million, to weed out illiquid, harder-to-buy stocks in the study.

As for Strategy #4, that’s what you could’ve achieved if you bought only the top “D”-Rated (SELL) stocks during the same time period. Strategy #2 assumed you did the same for “B” (BUY) stocks, while Strategy #3 was for “C” (HOLD) names.

These figures are hypothetical, of course, and based on back-testing. But you can easily see a direct relationship: Higher Weiss Ratings equaled stock market outperformance. I believe that shows that the higher the rating of the stocks you buy, the better your chances of investment success.

Why? Well, we’ve all heard about the investing prowess of legendary investor Warren Buffett. He mainly looks for strong cash flow generation over long time frames from companies with some sort of durable competitive advantage (a protective “moat” around their business, as it were). But he stresses nothing about timing his investment purchases other than to opine that “It’s better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

That means he’s definitely not emphasizing technical data, which is the study of price movement and fluctuations. On the other hand, technical traders look almost exclusively at price patterns. They’re looking to capitalize on price dislocations, overextended situations, and support/resistance levels, and to improve their purchases, sales, and stop loss placements.

So which approach is “right”? The answer, in my opinion, is both.

And that’s why I use our Weiss Ratings model, which looks at both fundamentals and technicals to help pick stocks. The model assesses earnings, sales, and cash flow generation over multiple periods, just like Mr. Buffett. But it also factors in price performance and volatility to identify which fundamentally strong stocks are starting to get recognition from the investment community by way of stock price appreciation – things that technical traders look for.