A Recipe for Investing in Gold

|

You know that the yellow metal is on its own rampage. It’s been partly fueled by fears about the economic impact of the Coronavirus.

But that’s only the tip of the big, powerful forces lining up to push gold higher:

- Negative interest rates ...

- Central bank money cannons ...

- Shrinking mine output ...

And more.

Gold was going higher anyway. Fear over the Wuhan virus gave the metal an extra kick in the pants.

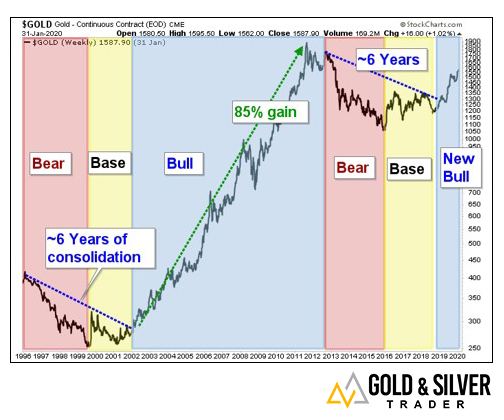

Now, I’ve shown you charts (examples here and here) of the recent bullishness in gold and miners. But you know that I like to take a longer-term, cyclical view. Here’s a multi-year chart that should shake the sleep out of your eyes.

|

Gold is very cyclical. It goes through bull and bear markets. You can see that gold was in a bear market, and then a base, for six years starting in 1996. It then blasted off in 2002 and racked up an 85% gain.

Gold then went into another bear market, followed by another base. That also lasted roughly six years, ending in 2019. Just to remind you, that’s when we started seeing the metal make big moves up. Since breaking out last year, gold is up 11.5%.

Gold Is Cyclical.

Even if history doesn’t always repeat, it often rhymes. I’d say gold has a lot higher to go.

So how do you play this? Right now, junior gold miners are leaving everyone else in the dust.

Here’s a chart showing the performance of gold versus three mining ETFs — the VanEck Vectors Gold Miners ETF (NYSE: GDX), Global X Gold Explorers ETF (NYSE: GOEX) and the VanEck Vectors Junior Gold Miners ETF (NYSE: GDXJ) — since the metal broke out in November.

|

As I mentioned earlier, you can see that gold is up 11.5%. Comparatively:

- The GDX is up 12.7%.

- Explorers are up 14.1%.

- And junior miners are up 18.7%.

Nice!

Some of the leading names in the GDXJ are Sibanye Gold (NYSE: SBGL), Kinross Gold (NYSE: KGC), and First Majestic Silver (NYSE: AG).

The Gold & Silver Trader portfolio holds other power-packed stocks, too. Some you might know. Some aren’t famous ... yet. But they will be.

Heck, our best performer is a stock I can almost guarantee you’ve never heard of. And we’ll be adding a lot more. As I said, this bull is still young.

This gold bull has all the right ingredients.

If you’re doing this on your own, be careful. There are plenty of scoundrels out there, and bad luck can dog even good miners. Remember, use adversity (pullbacks) to your advantage and keep the panic at bay.

But the time to get active in gold and miners is now.

All the best,

Sean