Bank Profits are Surging - and the Favorable Regulatory Environment Could Make Things Even Better

Bank profits are already surging. But there is so much going on in Washington right now on the regulatory front that things could get even better.

Bank profits are already surging. But there is so much going on in Washington right now on the regulatory front that things could get even better.

The proposed tax plan would cut taxes for corporations, including banks. The recent roll back of the Consumer Financial Protection Bureau’s (CFPB) arbitration rule has already made waves across the industry. And the rule that allowed consumers to file a lawsuit or join an existing lawsuit if they were harmed by a financial institution is no longer there. All of that means fewer litigation fees and lower taxes, which should boost the already-fat bottom lines that banks are reporting.

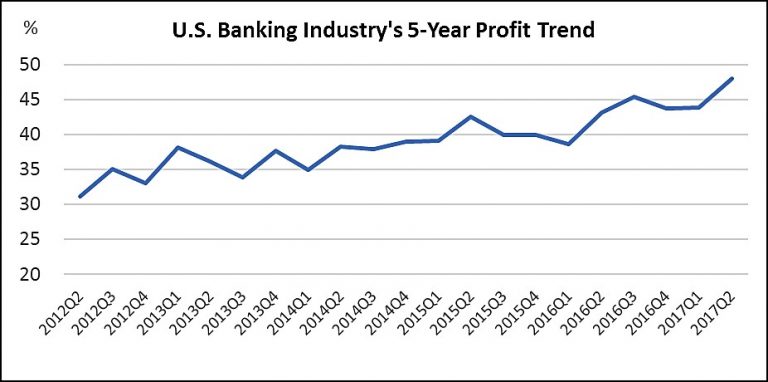

Let’s start by looking at both the latest data and the five-year bank profitability trend. It shows that, despite some ups and downs along the way, profits are rising solidly.

The overall industry grew its bottom line by 54.3% over the last five years, with profits rising from $31.1 billion in Q2 2012 to $48 billion as of Q2 2017. Earnings are up 9.6% since the prior quarter alone.

So, these are the numbers for all banks in the country. But which ones pull in the biggest profits?

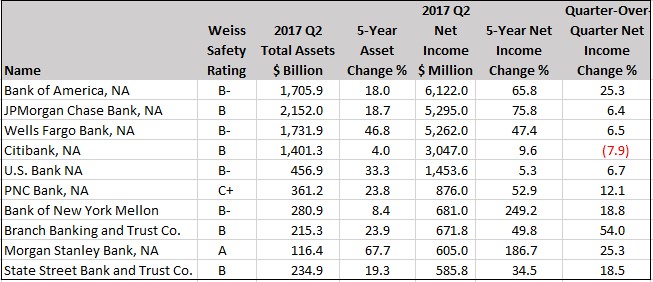

As you might expect, some of the largest banks are in the lead. The table below is sorted by current net income. It shows 5-year and quarter-over-quarter growth, together with growth in size by assets.

Top 10 Most Profitable Individual U.S. Banks

Almost all of the banks above recorded profit growth over the last five years and quarter-over-quarter. Citibank, NA (Rated “B”) was the only one who reported a quarterly drop of 7.9%.

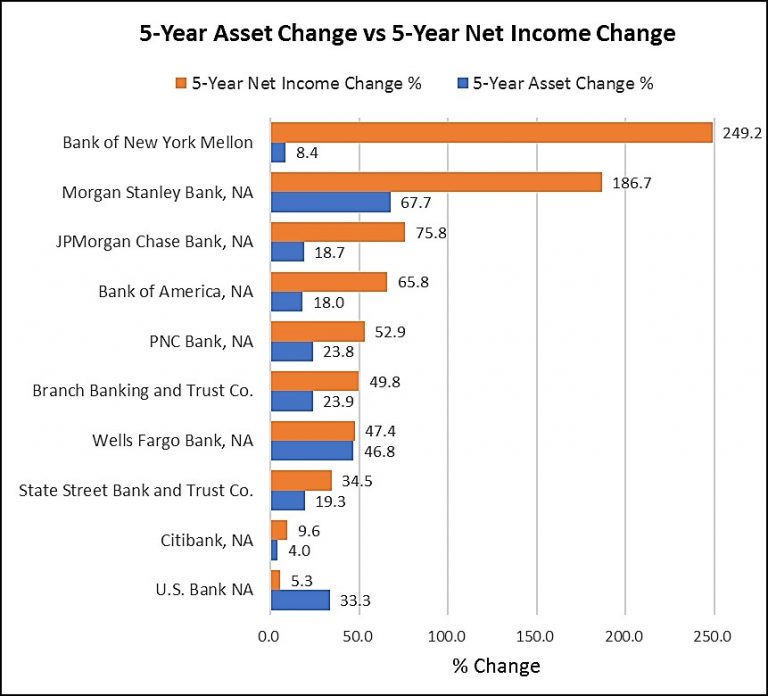

Meanwhile, profit at Bank of New York Mellon (Rated, “B-”) skyrocketed 249.2% when compared to Q2 2012, even as its total assets grew only 8.4% over the same time period. Morgan Stanley Bank, NA (Rated “A”) was another bank with a steep 5-year net income growth rate of 186.7%, but a significantly smaller 67.7% increase in assets.

For most other banks on the list, asset and income growth was more proportional. See the change in 5-year assets and net income in the graph below. But it’s also clear that asset changes don’t always reflect how fast net income grows.

Finally, our safety ratings indicate that eight of the ten banks above fall into the “B” range, which is considered “Good” by Weiss. One is rated “A” – “Excellent” – and one is rated “C+” – at the top of the “Fair” range.

The bottom line is that banks have been recovering strongly since the Great Recession and are now showing solid profits. The favorable regulatory environment will only keep driving profits higher as less money will be spent on taxes and litigation fees.

Still, it behooves you to check out your bank’s safety rating on the Weiss Ratings website, as well as add it to your Watchlist. That way you can be sure your funds aren’t in any danger, and keep abreast of any future changes in rating.

Think Safety,

Remi Lukosiunas

|

Remi Lukosiunas, a Financial Analyst, joined Weiss Ratings in 2014 with a financial services background in internal audit and the credit union industry. Remi conducts banking, credit union, insurance and investment research. He has also written extensively on stocks and investing using ratings as a guide. Remi is a graduate of Florida State University with a degree in multinational business. |

Money and Banking Edition, By Remi Lukosiunas, Financial Analyst

Money and Banking Edition, By Remi Lukosiunas, Financial Analyst